Remember a few years ago when Marie Kondo was all the rage? Everyone was looking at their homes and figuring out what sparks joy. The phrase became kind of like a mantra for living a minimalist lifestyle. However, for many of us, living with only a few possessions is just not feasible.

Most of us came out of that brief period of time with basements and closets still full of clutter. And you know what, that’s totally fine!

However, when you’re planning to sell your home, one of the biggest favours you can do is declutter–and be relentless about it.

Selling your home can feel overwhelming for even the most organized person. But with some planning and a little accountability, you can easily declutter your home and reap all the benefits.

Here are a few strategies we recommend:

First, Why is Decluttering Important?

For many homeowners, decluttering is the first step to preparing your home for sale. And for good reason. There are many benefits to decluttering. Here are just a few:

- If your home is being staged and photographed for listing, decluttering will give the stagers and photographers a better blank canvas to work with.

- Your home will appear bigger and less cramped during showings.

- It will be easier to clean the home with less clutter taking up space.

- Your home will present better overall with less clutter.

- When buyers enter your home, they want to picture themselves living in the space. Sometimes that’s hard when there is clutter in the home.

- You’re likely moving into a new home, so why would you want to bring a bunch of unused items into your new house?

- You will also likely be packing to move into your new home. Decluttering early on will help you get a head start on packing!

Decluttering is a great strategy for downsizers! Learn more about downsizing here.

How to Get Started

It’s easy to look at your massive list of tasks, get overwhelmed and then not do any of them. But with decluttering, we’ve found that it’s easier to break things down into smaller, more manageable tasks. Create a game plan for yourself and try to make it fun.

Think about the approach you want to take, maybe you want to start with the big items like furniture first. Or maybe you prefer a room-by-room approach. No matter what you choose, make sure you break things down into smaller steps for the most manageable and effective workloads.

You also don’t need to do it all in one day. If you have a few weeks before your home is going up for sale, take some time each night and do it little by little.

Looking for more resources to help you sell your home? Check out these blog posts and resources:

Different Methods for Decluttering

Everyone has their own methods, but when it comes to organizing your items, you can take a few different approaches. Here are some of our favourites:

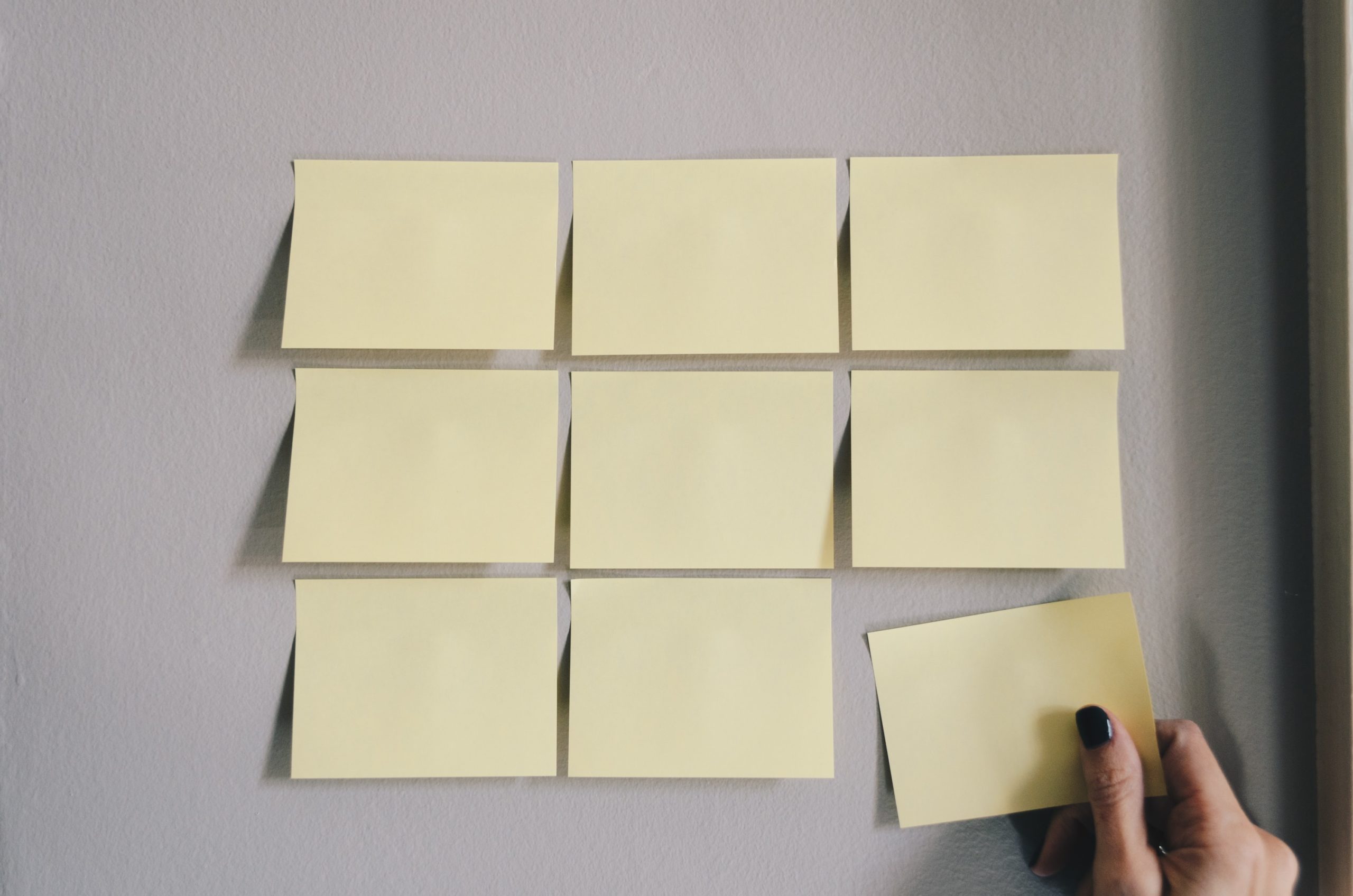

The Post-It Method

Head to an office supply store and pick up Post-It notes of different colours. Each colour represents a different action: keep, donate, sell, or trash. Go through your rooms and stick your Post-Its on the corresponding items. It will give you a better idea of the scale of stuff you are working with. It can also help you make faster decisions.

The Box Method

Similar to the Post-It method, this one involves different boxes with different purposes. This method would be ideal if you want to get started on your packing. Move different items to appropriate boxes. And then you have your moving boxes and the boxes that can get loaded into the car to be donated!

The 12-12-12 Method

This one is great for people who are doing things at a slower pace. The 12-12-12 method involves picking 12 things to pack, 12 things to donate, and 12 things to throw out every day. (If 12 seems like a lot, you can also change this to the 10-10-10 method or even 5-5-5 method if you prefer!

Moving with pets can add another layer of complications to your prep. Read more about how to move with pets right here.

Easy Things to Declutter First

Depending on your personality, you might find it easier to part ways with certain belongings over others. But for many of us, the majority of our unused clutter can be found in just a few rooms in the home. Here are a few places we recommend starting your decluttering:

The Closet/Wardrobe

Chances are, you have a lot of clothes you don’t wear. Items that might not fit so well anymore, trendy pieces that have sadly gone out of style, garments you’ve been meaning to get repaired. This is likely the easiest place to begin your decluttering journey. Take an honest look at your clothes and decide if something is worth keeping or if you should donate it. Organizations like Value Village or Dress For Success are always looking for well-maintained items. If you have any high-end pieces you hate to part with, you can also look into luxury consignment stores.

The Kitchen

Not sure what to do with that crock pot you never use? Or what about the crystal that barely gets used once per year? The kitchen is another area of the home that collects clutter. We recommend going through your small appliances, then your kitchen accessories, and lastly take a look at all the food in your fridge and cupboard. Look at expiration dates and get rid of everything well past its prime.

The Garage/Shed

If you have a garage, chances are, it has become an island for clutter. Old sporting equipment, unused tools, you name it. Many of these things can be donated to children in need if your kids aren’t using them anymore.

Looking for more home selling resources? Check out these pages here:

What to Do with Items You Don’t Want Anymore

Once you’ve identified everything you’d like to get rid of, now comes the challenge of figuring out what to do with it. Anything that should be thrown away or recycled will probably be pretty obvious. Services like 1-800-GOT-JUNK are perfect for an easy way to get rid of that household junk that you don’t want to move.

For items that you want to donate, it might be a good idea to ask friends and family if they’d like to take a peek first. You never know who has been secretly coveting your belongings at the family reunions!

Once your family has taken a look, you can bring those donations to any local charities or discount stores you prefer, The Salvation Army and Value Village are among the easiest choices for many people.

You can also sell things if that’s more your style. Facebook Marketplace, eBay, and other sites like Maxsold are gaining popularity for selling household items.

Looking to start your home selling journey? We can help with more than the decluttering! Reach out today and say hi here!